Decentralised or international companies rightly want a reliable, error-free and fast financial solution that meets legal requirements in various countries.

These are some challenges our customers face for which apintra has a solution:

(Worldwide) distributed locations

Different currencies

Different account systems and closing and valuation guidelines

apintra® solutions

All apintra® solutions are based on the same technology with equal advantages. These include multi-client capability, plausibility checks, open interfaces and local and temporal availability, as well as the ability to quickly find each individual data record.

BELOW IS AN EXCERPT OF THE FUNCTIONS THAT THE APINTRA® FINANCIAL SYSTEM PROVIDES:

- Dialogue booking entry with immediate processing

- Multi-user operation (simultaneous recording at different workstations)

- Profit centre management with consolidation (per client)

- Distribution posting with simulation function

- Open item balancing with integrated open item search and clearing simulations

- Clearing of several open items with only one entry – automatic correction for VAT discounts

- Freely configurable account system

- 14 accounting periods per business year

- Parallel posting in several posting periods (also across the fiscal year)

- Configurable, convenient data import from external systems

- Currency calculation with automatic booking of currency profit or loss

- Freely definable control keys

- Collective accounts

- Cross-year open item management

- Automatic clearing of open items

- Immediate posting to cost accounting and controlling

Some highlights

Processing of different control keys within one entry

Within a distribution posting, the use of different control keys (e.g. device and associated book) is allowed.

SQL search function in all visible fields

Each entry can be found quickly and easily. The search is carried out within a field or in any combination (creditor, debtor, G/L account, amount, date, etc.). For example, from 1 January of any year to 31 January of any year and any amount between 100.00 and 110.00 EUR. All booking records that correspond to these conditions are then displayed.

Automated cancellation bookings

Cancellation bookings, even in combination with highly complex distribution postings, can be made entirely automatically up to the period-end closing.

Consideration of a service date

The service date is used for to correctly declare VAT (e.g. for rent paid in advance). In addition to the document date, a different service date can be entered, which is used to calculate the VAT to be declared. A flag is also included to indicate whether the VAT has already been taken into account.

Evaluations according to different standards and purposes

- Evaluation groups for different accounting standards (HGB, IFRS, US GAAP)

- Booking journal

- Bank statements

- Open item evaluations

- Totals and balances list

- Economic evaluation

- Profit and loss account

- Balance sheet

- ODBC interface

- All reports optionally in PDF and XLSX format

Direct transfer of the tax code during booking

The user can freely choose which tax rate to use (without generating erroneous entries). Creating business or product posting groups is not necessary.

Sample booking entry screen:

(Extended version for accountants)

Move your mouse over the pulsating hotspots to find more detailed information.

Booking periods Up to 14 booking periods are taken into account.

Menu structure

The menu structure is user-dependent and individual.

Voucher / reference number

The document and reference numbers are different. This ensures more unambiguousness.

Example:

When the invoice is received, the document number and reference number are identical.

For related payments

- Document ⇒ Account statement number

- Reference ⇒ the document number to be cleared (which corresponds to the invoice number, for example).

Service date

The actual date of performance is recorded independently of the voucher date and is thus recorded correctly for VAT purposes.

Account selection

Depending on the posting symbol, the corresponding G/L accounts or debtors / creditors are displayed here for selection.

Booking history

All bookings entered by the clerk up to this point are displayed here.

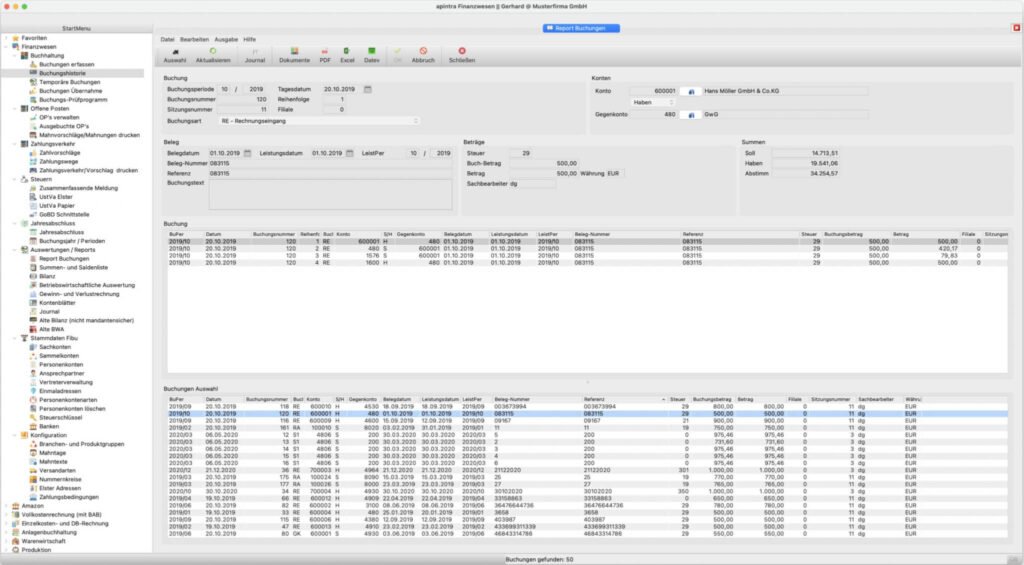

Sample report generator interface:

(Extended version for accountants)

Move your mouse over the pulsating hotspots to find more detailed information.

Search mask

This mask area can be used to enter the search terms according to standard SQL.

Examples:

To display all booking records between 500,- Euro and 510,- Euro, enter 500:510 in the field Book amount.

To see all entries for account 60001, just enter 600001 in Account.

Date limitations are made in the same way as for the amount. So 01.01.2021:01.02.2021 for all entries between 1 January and 1 February 2021.

Conditions can be linked as desired.

Details of a single booking

The details of a single booking are displayed here.

Results list

All booking records that met the search conditions are displayed here.

Additional included standard modules

IBAN payment transactions (payments and direct debits within the EU)

Recapitulative statement (EC statement, Saarlouis)

ELSTER interface (Germany) for transmitting data to tax authorities

The add-on IDEA module includes an interface to the digital tax audit. The module supports the principles for proper keeping and storage of books, records and documents in electronic form as well as for data access (GoBD) and replaces older regulations (GdPdU). The digital tax audit modules allow you to simulate a tax audit in line with international standards. The GDPdU module exports the data according to the IDEA standard. IDEA was originally developed by the Offices of the Auditor General of Canada. Later, the Canadian Institute of Chartered Accountants (CICA) and an international committee participated developing it further. Today, IDEA is a registered trademark of CaseWare IDEA Inc. In 2002, the German tax authorities equipped their external auditors with the IDEA audit software to carry out digital tax audits.

Reporting of raw data for intra-trade statistics (Federal Statistical Office, Wiesbaden, Germany)

Book your personal consultation right now.